Visa has reportedly offered Apple approximately $100 million to take over as the payment network for the tech giant's credit card, replacing current partner Mastercard, as Goldman Sachs plans its exit from consumer lending.

According to The Wall Street Journal, the payment network giant is making an aggressive push to secure the partnership, offering the kind of upfront payment typically reserved for the biggest card programmes, according to people familiar with the matter.

American Express is also competing to unseat Mastercard, with ambitions to serve as both the issuer and network for the Apple Card, sources told The Wall Street Journal.

Apple is expected to select a payment network before choosing a banking partner to replace Goldman Sachs, which has been trying to unload the Apple credit card since at least early 2023 as part of its retreat from consumer lending.

The battle highlights the strategic importance of the Apple Card, which has accumulated roughly $20 billion in balances, making it one of the biggest co-branded deals to change issuers.

Several financial institutions are vying to replace Goldman Sachs as the banking partner, including JPMorgan Chase, Synchrony Financial, and Barclays, according to previous reports.

Industry watchers suggest the competition extends beyond simple transaction volume. Apple is increasingly becoming central to many consumers' financial activities, with banks and payment networks developing what some describe as "frenemy" relationships with the tech company.

"The network that locks in this deal is expecting to stay close to Apple's future payments efforts," a source told the Wall Street Journal.

Mastercard is reportedly exploring ways to maintain its relationship with Apple, including potentially using its fintech subsidiary Finicity to enable consumers to view their deposit-account balances within the Apple ecosystem.

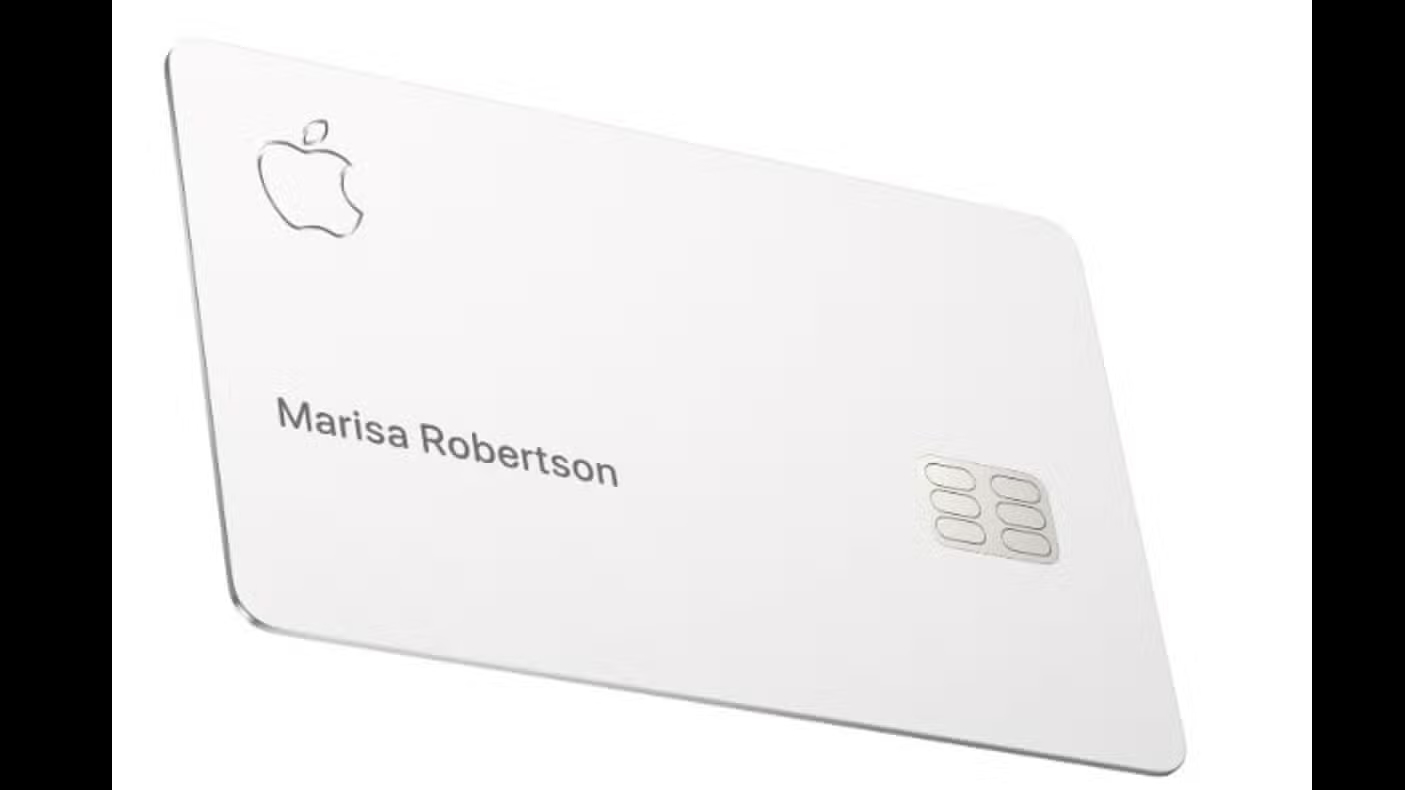

The Apple Card was launched in 2019 as a partnership between Apple and Goldman Sachs, with Mastercard serving as the payment processor. Goldman's decision to exit consumer lending has created the opportunity for competitors to pursue what has become a coveted financial partnership.

Latest News

-

Mizuho to replace 5,000 administrative roles with AI

-

Allica achieves unicorn status through latest funding round

-

AI disruption risk varies between platform and service-based firms, says new report

-

ClearBank moves into the heart of London’s financial centre

-

Citi forms AI infrastructure banking team and invests in Sakana AI

-

HSBC chief Elhedery says overhaul nearly complete despite profit fall

Creating value together: Strategic partnerships in the age of GCCs

As Global Capability Centres reshape the financial services landscape, one question stands out: how do leading banks balance in-house innovation with strategic partnerships to drive real transformation?

Data trust in the AI era: Building customer confidence through responsible banking

In the second episode of FStech’s three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech examines the critical relationship between data trust, transparency, and responsible AI implementation in financial services.

Banking's GenAI evolution: Beyond the hype, building the future

In the first episode of a three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech explores how financial institutions can navigate the transformative potential of Generative AI while building lasting foundations for innovation.

Beyond compliance: Building unshakeable operational resilience in financial services

In today's rapidly evolving financial landscape, operational resilience has become a critical focus for institutions worldwide. As regulatory requirements grow more complex and cyber threats, particularly ransomware, become increasingly sophisticated, financial services providers must adapt and strengthen their defences. The intersection of compliance, technology, and security presents both challenges and opportunities.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories