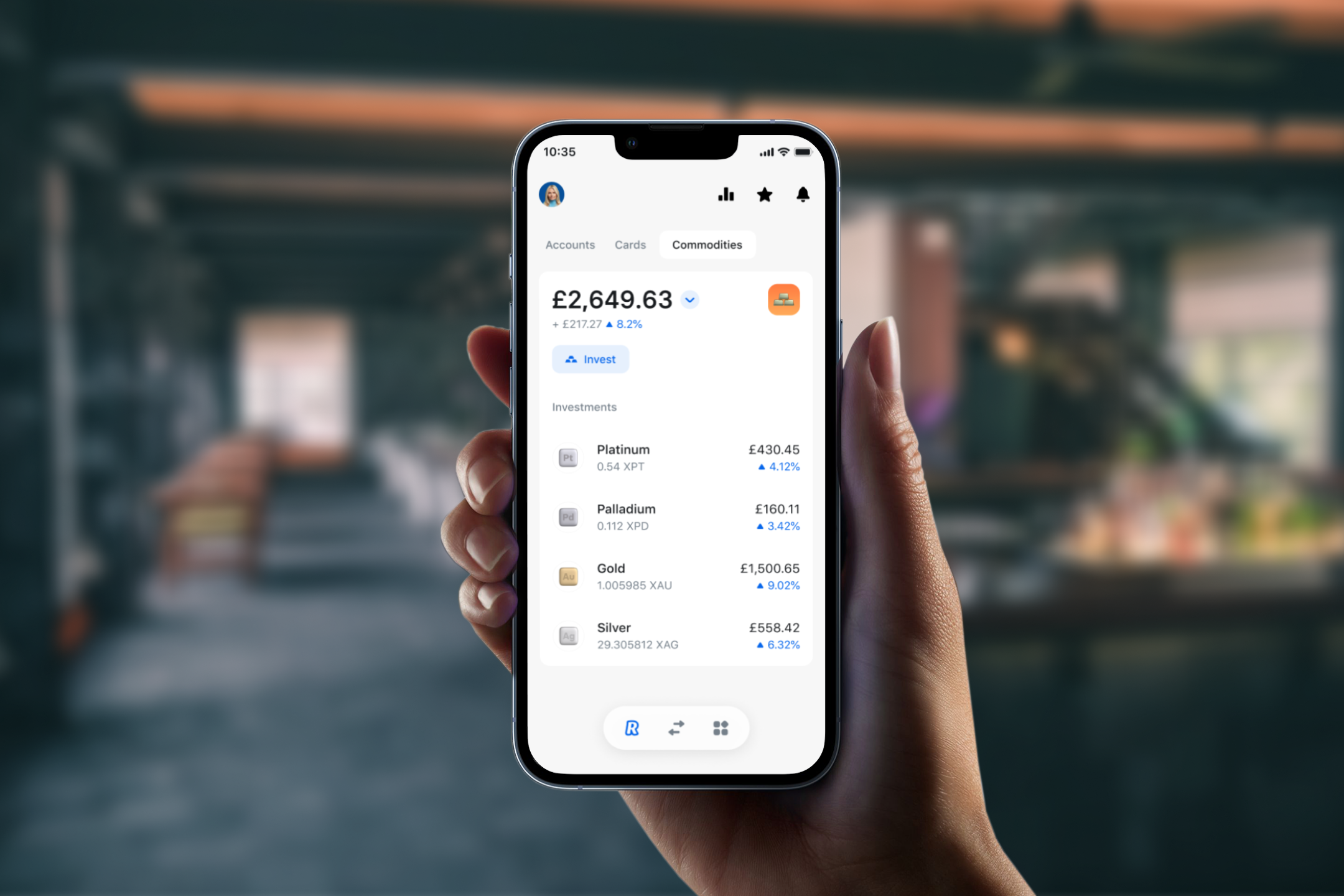

Revolut is introducing platinum and palladium to its list of commodities available for trading on its app.

Standard, Plus, Premium, and Metal customers based in the UK, EEA, and Switzerland will now be able to trade these precious metals through the digital platform.

The FinTech, which announced it had passed over 25 million worldwide customers last month, first launched its commodity trading feature with gold in March 2020. The company later added silver to the app.

Revolut has warned customers that, unlike fiat money, platinum and palladium are not currently regulated in the UK by the Financial Conduct Authority (FCA) or protected by e-money regulations.

The company said that customers can purchase and trade based on live market performance data which it gathers through its specialised partner.

It added that like gold or silver, platinum or palladium exposure can be transferred from one Revolut customer to another via the Revolut app, or converted instantly into cryptocurrency or e-money to make purchases.

Revolut also provides an auto-exchange feature where customers can set a certain price at which to trade platinum or palladium exposure, with the app automatically completing the transaction when the market price matches the target set.

“Many people still feel closed off from obtaining access to alternative assets such as commodities," said Yaroslav Kravchenko, director of wealth & trading at Revolut. "This is why we are stripping back the complexity and fees to make sure that getting access to Platinum and Palladium exposure is as simple and low cost as possible. Our goal is to open up as many options and financial products to customers as possible, so they can save, invest and manage their money in the way that they want.”

Revolut is now processing over 330 million transactions each month and attributes its latest customer milestone to its global expansion following this year’s expanded presence in the US.

The company said it has plans to move into further markets, including Latin America, South East Asia and the Middle East.

Latest News

-

Mizuho to replace 5,000 administrative roles with AI

-

Allica achieves unicorn status through latest funding round

-

AI disruption risk varies between platform and service-based firms, says new report

-

ClearBank moves into the heart of London’s financial centre

-

Citi forms AI infrastructure banking team and invests in Sakana AI

-

HSBC chief Elhedery says overhaul nearly complete despite profit fall

Creating value together: Strategic partnerships in the age of GCCs

As Global Capability Centres reshape the financial services landscape, one question stands out: how do leading banks balance in-house innovation with strategic partnerships to drive real transformation?

Data trust in the AI era: Building customer confidence through responsible banking

In the second episode of FStech’s three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech examines the critical relationship between data trust, transparency, and responsible AI implementation in financial services.

Banking's GenAI evolution: Beyond the hype, building the future

In the first episode of a three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech explores how financial institutions can navigate the transformative potential of Generative AI while building lasting foundations for innovation.

Beyond compliance: Building unshakeable operational resilience in financial services

In today's rapidly evolving financial landscape, operational resilience has become a critical focus for institutions worldwide. As regulatory requirements grow more complex and cyber threats, particularly ransomware, become increasingly sophisticated, financial services providers must adapt and strengthen their defences. The intersection of compliance, technology, and security presents both challenges and opportunities.

© 2019 Perspective Publishing Privacy & Cookies

.jpg)

Recent Stories