In an industry-first, Monzo has launched a new feature on its app that lets customers check if a call from someone claiming to be from the bank is legitimate.

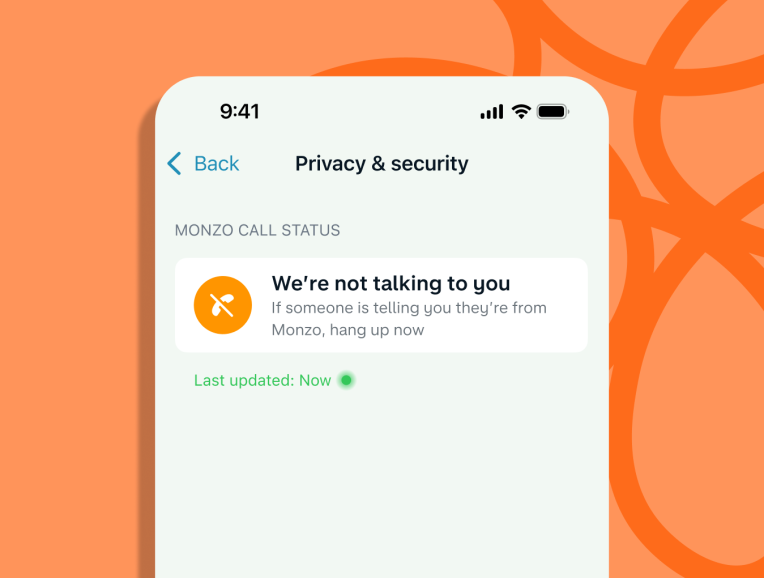

The digital-first bank said that when someone says they are calling from Monzo, customers can open the app and click on Privacy & Security in Settings to see if the caller is a fraudster or an employee.

If the ‘Monzo call status’ shows that a member of the Monzo team isn’t talking to the customer, they are advised to hang up immediately and report the call.

Customers can start a report by tapping the call status.

If the call status in the app shows that a member of the Monzo team is on the phone it means the call is from a legitimate staff member.

Monzo was recently rated Britain's top personal and business current account provider, according to the Competition and Markets Authority's (CMA) latest survey on banking satisfaction.

The league table is part of the Retail Banking Order, a set of reforms launched by the regulator after its retail banking market investigation in 2016.

Monzo reached profitability in March having recorded a near doubling of its profits in its latest financial year ended in February.

The British FinTech’s financials showed an 88 per cent rise in profits to around £214 million from £114 million in the previous year.

Monzo also recorded high losses, with a 42 per cent rise leaving overall losses for the year hovering at around £100 million.

“Our losses remained large this year, which was expected as we continued to invest and grow our business, resulting in higher costs,” said chair of the board of directors Gary Hoffman at the time. “But we’ve seen the benefits of this investment throughout FY2023 as revenues grew significantly and I’m thrilled that since the end of our audited financial year, this momentum has continued and we’ve reached profitability.”

Latest News

-

Gemini to cut quarter of workforce and exit UK, EU and Australia as crypto slump forces retrenchment

-

Bank ABC’s mobile-only ila bank migrates to core banking platform

-

Visa launches platform to accelerate small business growth in US

-

NatWest to expand Accelerator programme to 50,000 members in 2026

-

BBVA joins European stablecoin coalition

-

eToro partners with Amundi to launch equity portfolio with exposure to ‘megatrends’

Creating value together: Strategic partnerships in the age of GCCs

As Global Capability Centres reshape the financial services landscape, one question stands out: how do leading banks balance in-house innovation with strategic partnerships to drive real transformation?

Data trust in the AI era: Building customer confidence through responsible banking

In the second episode of FStech’s three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech examines the critical relationship between data trust, transparency, and responsible AI implementation in financial services.

Banking's GenAI evolution: Beyond the hype, building the future

In the first episode of a three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech explores how financial institutions can navigate the transformative potential of Generative AI while building lasting foundations for innovation.

Beyond compliance: Building unshakeable operational resilience in financial services

In today's rapidly evolving financial landscape, operational resilience has become a critical focus for institutions worldwide. As regulatory requirements grow more complex and cyber threats, particularly ransomware, become increasingly sophisticated, financial services providers must adapt and strengthen their defences. The intersection of compliance, technology, and security presents both challenges and opportunities.

© 2019 Perspective Publishing Privacy & Cookies

.png)

Recent Stories