The future of financial services is agile, that is all organisations must be fast to create new services, fast to respond to competitors, innovative and, above all, stable. Agile companies do not become unbalanced, they maintain seamless operations at the same time as creating change.

As consumers shift from bricks to clicks, financial service institutions will need to keep up with the needs of growing number of ‘digitally-savvy’ consumers. In the UK, 4 in 5 (80 per cent) of consumers now use some form of online banking, with the spread reaching across generational divides. Customers of all ages now expect more and better in an increasingly connected world, where finance is seen as frictionless and failure to deliver means switching providers in an equally frictionless way.

Customer behaviour across all channels is pressing financial institutions towards faster digitalisation. The shift online, the expectations of speed of delivery for new products and the need for greater cyber security all put an onus on financial service providers to create better offerings. In turn, they too seek deeper and more useful analytics for enhanced business intelligence, strategic planning and targeted marketing.

It is little wonder that against this backdrop, banks are turning to technology such as cloud to enable this transformation and create stable infrastructures that can respond to the demands of the next generation of customers.

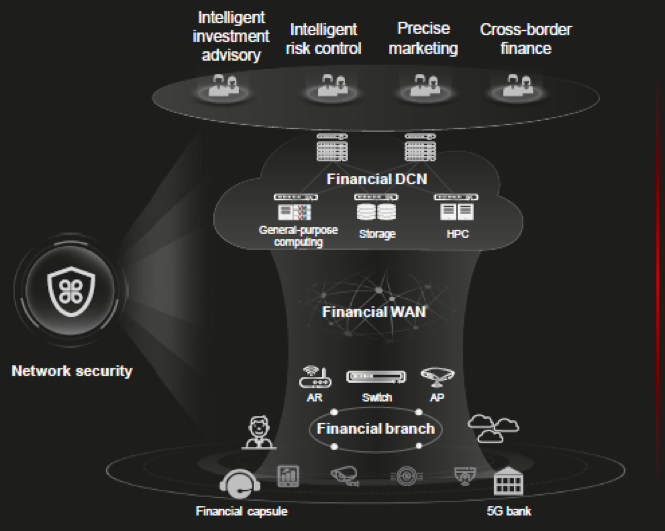

It is with all this in mind that Huawei launched its Financial Cloud-Network at the recent Huawei Intelligent Finance Summit, to enable financial service institutions (FSIs) to successfully move their core business processes to the cloud and maintain a stable and agile architecture that serves their customers. The summit was themed “Accelerate Financial Digitalisation, New Value Together” as a nod to the importance of digital ecosystems as foundations of future intelligent financial services. The end goal is to accelerate financial digitalisation, deliver secure and reliable financial services, and lay the cornerstone of connectivity for intelligent finance as service providers and their technology partners create new value together.

The timing is also important, as FSIs are currently disrupted by a surge in new entrants, with FinTechs that have no legacy issues and can build services quickly, offering aggressive competition.

To best consider how Huawei’s Financial Cloud-Network can, and has, helped FSIs, it helps to break the technology down into different scenarios in order to understand how the company can help institutions with particular issues within the overall solution.

First, the ability to create a Financial Data Center Network (DCN) and its use by the China Merchants Bank demonstrates how speed can be achieved in the network.

In the digital era, China Merchants Bank (CMB) sees that its biggest competitive advantage lies in its wealth management business on top of its retail finance business. However, in order to capitalise upon this, it faced issues with network packet loss and delays (causing low AI training efficiency, manual network verification and design that created slow service delivery and ‘black boxed’ services creating issues with operations). Each in turn could cause less optimal marketing or client acquisition, and large data losses.

With Huawei's Autonomous Driving Network, this existing complex network could be replaced with a cloud-based solution that paved the way toward a network as a service (NaaS) solution providing full-process and full-lifecycle automation with network deployment within minutes. In addition, the solution provided network health, diagnosis and fault self-healing with its intelligent operations and maintenance (OM).

China Construction Bank faced a different issue, needing a network that could handle all needs across the backbone to the branch.

For this, the Bank needed a Financial Wide Area Network (WAN) solution, enabling a cloud-based intelligent network. The advantages were to allow a highly scalable solution that was flexible, and self-healing. The results offered a SRv6-powered ultra-high bandwidth network with intelligent traffic optimisation on the cloud backbone, high-speed interconnections and flexible on-demand expansion, meeting not only the needs of today but also the potential to meet all the access requirements of the future. This is done via network slicing, giving three service networks over one physical network a high-speed forwarding for intra-bank financial service traffic, one for Internet traffic and forwarding for external services.

Dubai International Financial Centre (DIFC) has another need, prioritising Connectivity and Accessibility with Wi-Fi. Having realised the importance of digitalisation ahead of the arrival of COVID-19, the pandemic played a role in accelerating the adoption of all digital channels offered by DIFC with full access to services and connectivity for clients.

A core component of the transformation was launching next-generation Wi-Fi 6 in partnership with Huawei, offering the fastest Wireless Local Area Network (WLAN) technology to date. The new solution was deployed across public areas in DIFC, reinforcing the centre's position as the most advanced financial hub in the MEASA region. As DIFC looks to triple in size by 2024, the launch of Huawei's AirEngine Wi-Fi 6 will help DIFC meet its growing connectivity requirements, ensuring its community has access to the latest technology and network, with the capacity to support innovative smart services.

Alya Al Zarouni, executive vice president of operations for the DIFC Authority, said: "Connectivity is the key to every aspect of infrastructure development in DIFC — we connect our community, physically and digitally, in the same way we connect the various facets of a financial ecosystem. With the rapidly evolving demands of professionals based in and visitors to the Centre, it's our responsibility to ensure we are offering the latest technological services. We are incredibly pleased to have launched Wi-Fi 6 in partnership with Huawei and believe it will be a game-changer for the DIFC community."

Likewise, the Industrial and Commercial Bank of China (ICBC) Argentina was in need of a Wi-Fi solution to help legacy equipment (from the purchase of predecessor Standard Bank Argentina) cope with rapidly developing mobile commerce, increasing customer demand for Internet finance and new payment modes, and the exponential growth of business volumes from various service channels.

Eager to deploy a solution that could cope with its immediate network challenges as well as fulfill its long-term plans, ICBC Argentina opted for Huawei's agile wireless network solution. The solution, based on industry-leading, next-generation AirEngine Wi-Fi 6 technology, represents a mindset that is future-oriented and full of initiative.

Even though the case studies above demonstrate how powerful and flexible Huawei’s Financial Cloud-Network concept is at delivering tailored solutions to individual FSI issues, cyber-security remains an overarching and significant problem that all companies face.

Here, the “Zero-trust” Financial Network Security delivers network-wide situational awareness. This added layer of security is critical as FSIs increase the number of endpoints within their network and expand their infrastructure to accommodate more applications and transactions.

Meaning that, whatever the major concern, Huawei can offer not only a solution to this and a complete network upgrade, but also this can be done with the knowledge that the network will be safe, stable and agile enough to keep up with demand for swift rollout of digital services.

Stable and Agile, Architecture of Huawei Financial Cloud-Network

Learn more about Huawei’s Financial Cloud-Network Solution, how it delivers a rapid roll out of new applications to dynamically scale services, and provides a highly reliable and low-cost financial solution.

Latest News

-

Gemini to cut quarter of workforce and exit UK, EU and Australia as crypto slump forces retrenchment

-

Bank ABC’s mobile-only ila bank migrates to core banking platform

-

Visa launches platform to accelerate small business growth in US

-

NatWest to expand Accelerator programme to 50,000 members in 2026

-

BBVA joins European stablecoin coalition

-

eToro partners with Amundi to launch equity portfolio with exposure to ‘megatrends’

Creating value together: Strategic partnerships in the age of GCCs

As Global Capability Centres reshape the financial services landscape, one question stands out: how do leading banks balance in-house innovation with strategic partnerships to drive real transformation?

Data trust in the AI era: Building customer confidence through responsible banking

In the second episode of FStech’s three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech examines the critical relationship between data trust, transparency, and responsible AI implementation in financial services.

Banking's GenAI evolution: Beyond the hype, building the future

In the first episode of a three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech explores how financial institutions can navigate the transformative potential of Generative AI while building lasting foundations for innovation.

Beyond compliance: Building unshakeable operational resilience in financial services

In today's rapidly evolving financial landscape, operational resilience has become a critical focus for institutions worldwide. As regulatory requirements grow more complex and cyber threats, particularly ransomware, become increasingly sophisticated, financial services providers must adapt and strengthen their defences. The intersection of compliance, technology, and security presents both challenges and opportunities.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories