Huawei’s Industrial Digital Transformation Conference shone a light on the progress and future path for banks as they complete the leap to being fully digital competitors in the new age of finance.

During the Financial Services session of Huawei’s conference, Ben Yang, VP of Huawei’s Global Financial Services Business Unit, wanted to share the experiences of leading banks during this extraordinary year, demonstrating the resilience and opportunities that digital transformation can give as banks re-invent themselves in the digital economy and aspire to lead the revolution.

The importance of this transformation can be seen in China during its annual Spring Festival holiday week. While payments using traditional credit and debit cards were almost flat, payments through mobile applications surged more than 80 per cent. Huawei customers such as China Merchants Bank, who had rapidly moved to a mobile-first position using Cloud techniques, could handle this type of surge in volume and improve their competitive position, reinforcing their position and gaining customer appreciation.

This brings into focus the need for effective and integrated infrastructure – an area where banks have traditionally been slow given the legacy systems and underinvestment issues they have faced. These have direct consequences in slowing down the required transformation, but also have a secondary effect of creating a culture within the banks that is not ready to move at speed – especially against nimble FinTechs.

For this a trusted partner is essential – or as Ben Yang says: “As those of you who are our customers will know, we are always trying to find ways to increase our value to our customers and help them to succeed. One way we do that is to establish Strategic Cooperation agreements with leading banks and, in many cases these include joint development to explore new concepts such as IoT, AI and Blockchain.” Touching on some of incoming technologies that will need to be incorporated into any bank’s offerings in a digital world.

Huawei has spent considerable time analysing the essential elements needed to create change, even creating a group of senior experts, led by the previous CIO from China Merchants Bank, to help share the knowledge of how banks in China adapted and increased their pace of digital transformation.

With more than 180 video sessions, primarily with CEOs and CIOs, four major themes were identified to help guide banks towards a better digital future: ICT Infrastructure Modernisation, Cloud Adoption, Inclusive Financial Service and Industrial Financial Service.

Accelerate ICT Infrastructure Modernisation. This is much more than just updating existing infrastructure and putting in place the architecture for digital transformation, it involves creating a simple and yet smart infrastructure and a shift to mobile-first.

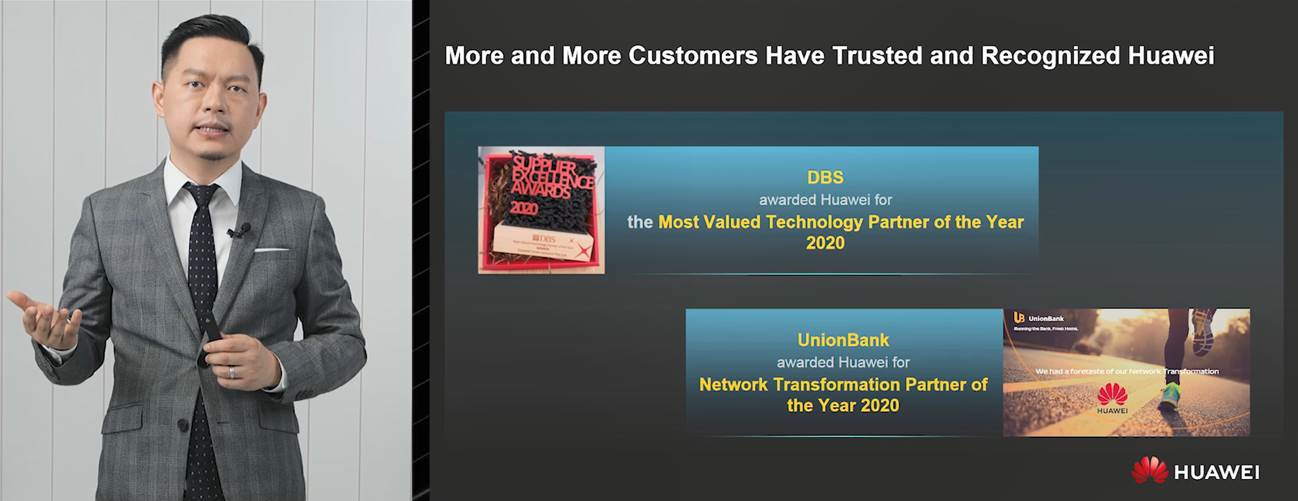

Ben Yang points to the example of DBS in Singapore: “We were able to help them rapidly reposition to allow remote work, including finding servers to support 4000 VDI users within about one day. We were happy to help with these efforts, among others and were very honoured to receive their Most Valued Technology Partner award.” The rapid response is impressive – but it is because DBS had both a deep partnership relationship and because its infrastructure allowed this that needs to be highlighted.

In terms of a digital future, such an infrastructure allows for Robotic Process Automation, that can reduce traffic and data pressure allied to a fully robotic bank infrastructure covering the network, storage and security, enabling complete end-to-end intelligence from branch offices to Cloud data centres. Moreover, a robotic solution not only provides drill-down information across the entire network, it makes deployment quick and seamless to the consumer.

Cloud Adoption is an essential element in any move to mobile, allowing organisations to become agile. Whether the Cloud is an entirely on-premise Private Cloud, entirely in a Public Cloud or using the increasingly important Hybrid Cloud architecture, when you have digital engagement, there will be access to huge amounts of data, far beyond that which traditional data warehouses are designed to deal with. Cloud provides the only logical solution, allowing the creation of Data Lakes, Big Data and AI techniques to improve risk management, create new services and provide greater value to customers.

China Merchants Bank’s success during the Spring Festival, mentioned earlier, is built on the use of Cloud, and the development of “Super Apps” that allow third-party partners to collaborate via Cloud-based Open API and Open Connect capabilities to create rapid and full deployment. To achieve speed and depth of deployment as in this case, only Cloud can provide the required power.

Financial Inclusion Ben Yang was effusive on the subject during the conference, saying it is “an extremely important subject, particularly in countries where many people do not have access to conventional financial services. You may not have known that Huawei has offerings in this area, but we have implemented four of the five largest mobile money platforms”.

In the last five years KCB has digitised financial access, enhancing inclusion and democratising its services. As well as main access, micro, and nano entrepreneur access has been enabled, and KCB is now a major player in the mobile payment space and mobile banking. As Joshua Oigara, the Group CEO of KCB Group states: “The reason why we do that is we work across all aspects of our customer’s footprint.” This is where the app-based solutions developed with Huawei and based on an agile infrastructure allows an API integration framework to extend the reach of the bank.

Likewise, MuRong and Huawei have cooperated to provide solutions to NCBA, one of the top three banks in Kenya. The NEO platform is the core platform for digital services using Cloud architecture to provide mobile banking services for tens of millions of users. The hardware configuration was less expensive than before, the database software authorisation cost was reduced by half, the TPS was improved by five times, the transaction processing duration was shortened by half and the daily batch processing duration was shortened by a fifth. Open technologies, automatic tools, and microservice architecture were adopted, as a result, TTM was a third of the original. The new platform not only solved existing problems of banks, but also provided a strong impetus for business development, helping them to make financial services accessible to more people.

After NCBA Bank Kenya’s system successful launch, NCBA group chairman Isaac Awuondo commented: “The successful rollout of this project is far beyond our team's expectation. It's the first smooth service rollout that I've ever seen during my over 30 years in the banking industry."

The last pillar is Paving the way to Industrial Financial Services, which is really about the future. Whether it is autonomous vehicles driving themselves to charging stations and automatically paying, or banks using IoT to offer innovative financial services such as use-based purchases, Industrial Financial Services will be key to expanding financial services in the future.

Shanghai Pudong Development Bank (SPD) provides an example. Together with Huawei they created a new concept — the Bank of Things (BoT) where IoT, AI, Cloud and Blockchain converge, and the virtual and physical worlds are integrated. Here the supply-driven or demand-driven mode is changing towards a new economic operation mode that features supply-demand collaboration and in-depth integration of R&D, products, financial institutions, and commerce. IoT will also reshape the future financial service system and transform the subjective credit system into an objective system. ‘Intelligent things’ connected to the IoT will generate an unprecedented amount of data. For banks, this means wider customer reach, more personalised financial services, and more effective risk control.

As Ben Yang sums up: “The future will see financial companies increasingly become integrated into all aspects of all industries’ businesses, which is really exciting.” Which might just be a great understatement as banking moves into a whole new area of global commerce, both geographically and in terms of how transactions are made in a completely changing economy.

As new technologies emerge, the pace of development and the future looks increasingly bright for financial services innovators. Companies like Huawei are leading the way; the company has helped major banks through the challenges of the last year and has gained the wisdom and expertise to inform how a digital future can be bigger, bolder and better under the four pillars of digital success.

About Huawei

At the end of 2020 Huawei had customers in more than 60 countries and had increased its share of the Top 100 banks to 47, it recently broke over over 2,000 customers, a new milestone for its FSI business.

Along with the Most Valued Technology Partner award 2020 from Singapore’s DBS Bank, Huawei was awarded the Network Transformation Partner award 2020 from Union Bank Philippines.

Huawei continues to be completely committed to the Financial Services Industry – it is the fastest growing vertical market for Huawei and it believes that success in supporting customers in this market will be a key to its overall success in the Enterprise market.

Learn more about Huawei’s solutions for Financial Services here.

Latest News

-

Digital euro rollout could cost banks up to €6bn

-

Matthew Harvey appointed head of digital at NatWest Markets

-

b1Bank deploys agentic AI agents for daily workflows

-

Visa to accelerate advanced tech rollout with Prisma and Newpay acquisition

-

Societe Generale joins LSEG’s model marketplace as part of new venture

-

ClearBank poaches Uber exec to lead European growth as CEO

Creating value together: Strategic partnerships in the age of GCCs

As Global Capability Centres reshape the financial services landscape, one question stands out: how do leading banks balance in-house innovation with strategic partnerships to drive real transformation?

Data trust in the AI era: Building customer confidence through responsible banking

In the second episode of FStech’s three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech examines the critical relationship between data trust, transparency, and responsible AI implementation in financial services.

Banking's GenAI evolution: Beyond the hype, building the future

In the first episode of a three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech explores how financial institutions can navigate the transformative potential of Generative AI while building lasting foundations for innovation.

Beyond compliance: Building unshakeable operational resilience in financial services

In today's rapidly evolving financial landscape, operational resilience has become a critical focus for institutions worldwide. As regulatory requirements grow more complex and cyber threats, particularly ransomware, become increasingly sophisticated, financial services providers must adapt and strengthen their defences. The intersection of compliance, technology, and security presents both challenges and opportunities.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories