In today’s fast-changing world, finance is slated to play a pivotal role in driving economic development and growth. To do so, technological advancements in the financial industry are of utmost importance which could then propel the transformation of other industries, unleashing new value together.

Emerging business models and service scenarios in a digital world

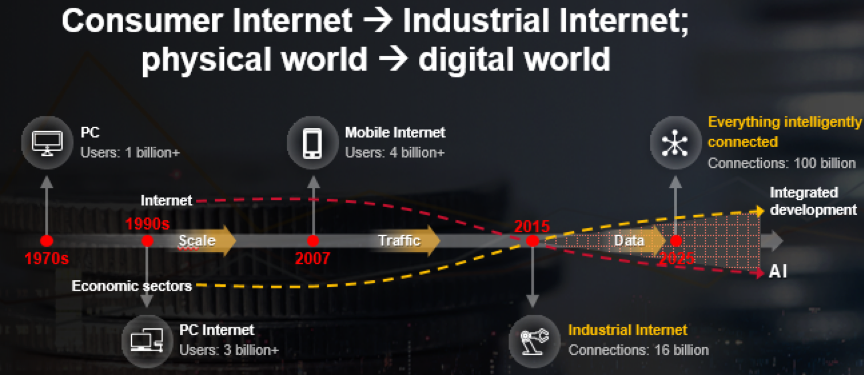

In the past, we've seen mainstream technologies transition from PCs to the Internet, mobile Internet, and now the industrial Internet. As the Internet of Things (IoT) develops, what the internet connects is no longer limited to human beings but all sorts of things.

In 2015, there were 16 billion connections; by 2025, this number is slated to reach 100 billion.

The Consumer Internet has enriched our communications and everyday lives. But the Industrial Internet has gone a step further by connecting the B2B and B2C supply chains as well as internal and external business activities and data, reshaping the business value chain in traditional industries. As a result, everything in our world is intelligently connected.

Transition to a digital-first economy

In the past, large-scale monetization mainly came from hardware and software sales. With the rise of consumer Internet, OTT vendors monetized Internet portals for traffic.

Today, with the industrial Internet, enterprises ought to improve efficiency and service flows and draw on massive data to monetize technologies. In this transition, an array of new services such as online trading, digital logistics, mobile payment, and remote communications have emerged.

China is one of the leaders in digital economy development. In 2020, the country's digital economy grew at a whopping 9.7%, 3.2 times higher than the global nominal growth rate of GDP over the same period.

The total scale reached CNY39.2 trillion, contributing 38.6% towards the GDP, indicating that the digital economy is the key to economic recovery and stable economic growth.

Implications for the financial services industry

These changes reflect a slew of ICT upgrades, which have had a profound impact on the financial services industry and many more. Changes include:

• Always on: New ICT has enabled real-time interaction and behavior interconnection. Mobile devices are the optimal platform to deliver innovative customer experiences while also facilitating internal collaboration, leading to the rise of brand-new service models.

• Super intelligence: 5G enables intelligence on devices, edges, and clouds, supporting distributed all-scenario AI and smart contracts anywhere. Ubiquitous intelligence powers intelligent and real-time decision-making models.

• Everything intelligently connected: More than 100 billion IoT devices will stimulate new business scenarios. Unlike traditional banking that only serves people, the Bank of Things will also support services for smart things, driving the rapid development of industrial finance.

• Distributed collaboration: A new bottom-up model that consists of multi-platform, multi-node, and distributed collaboration engages a variety of stakeholders to unleash business potential.

Key capabilities required from businesses to stay competitive in the new digital era

As new market scenarios emerge constantly, from autonomous driving to intelligent coal mines and warehousing, the finance sector needs to be well-equipped to support new business models, whilst being the driver for innovation. Three capabilities are critical in such process:

1. Agility is at the core. Financial institutions need to figure out ways to achieve technological, business, and organizational agility through digital transformation, more responsive to changes

2. New risk control concepts and models are necessary. When everything is intelligently connected with in a real-time model, risk control needs to be data-based, real-time, and intelligent.

3. A robust ecosystem is crucial. As distributed collaboration called for the need to create an open and integrated cross-industry ecosystem, rather than placing the responsibilities on one single financial institution.

Role of technology companies in supporting the transformation of the industry

Cloud technologies will be a key solution to the above needs. The transition from resource-centric cloud 1.0 to application-centric cloud-native 2.0 address a number of challenges faced by the financial services industry. Cloud technologies enables agile innovation and data intelligence and are essential in connecting everything and enabling cross-scenario innovation. Clouds will also help connect industry ecosystems and provide untethered services.

To support the much-needed upgrades in the finance industry, Huawei will focus on the following three strategic initiatives:

1) Agility: Embrace cloud-native technology, build optimal infrastructure through technological innovation, accelerate the integration of data and intelligence, and build agile digital platforms. These changes will help financial institutions achieve agility, equipping them to perceive and respond faster to changes while accelerating intelligent and secure data processing and transfer.

2) Ecosystem: Aggregation of SaaS services to build an open ecosystem for all scenarios. Huawei partners with capable stakeholders in the financial services industry, together our combined know-how, experience, and innovation efforts create synergies to develop industry-leading solutions, as well as an open, converged, and cross-industry ecosystem.

3) Industrial finance: Focus on the industrial Internet, we address real-life challenges facing the industry, accelerating digitalization through use of technologies, speeding up secure transfer of data, unleashing the value of data, building new service scenarios and models, and connecting scenarios across industries. This will create a business supply chain across traditional sectors, further integrating financial services with other activities.

Future industry outlook and opportunities

In the financial services industry, "subject credit" is shifting to "subject credit + transaction credit". As industries go digital, they need to obtain objective and reliable transaction data whenever they need it and in real-time. Only if base data assets can be transferred securely can industries build new models and unlock the value of digitalization.

To this end, Huawei offers full-stack cloud, device, and edge capabilities through aggregation of more SaaS services, strengthening the ecosystem, and closer collaboration with financial institutions to build new financial services in all scenarios, creating new value together.

Huawei's journey in the financial services industry

Since entering the financial services industry a decade ago, Huawei has empowered 2000+ financial customers in more than 60 countries and regions, including 47 of the world's top 100 banks. Huawei has become an important partner in the digital transformation of the financial services sector worldwide.

In China, Huawei ranks first in both financial cloud infrastructure and data infrastructure markets. Internationally, Huawei was the only technology partner to be awarded the Most Valued Technology Partner by DBS Bank in 2020. Huawei’s highly reliable and scalable storage solutions have supported top international institutions such as Itaú, Sympany, Piraeus Bank, and FTLife in ensuring a stable operation of core transactions and business expansion.

In addition, Huawei's mobile money solution helps GCB Bank develop a mobile payment platform and inclusive financial services, achieving a 10-fold increase in its mobile services.

Huawei has also deployed a new digital service core system for NCBA, a commercial bank with the largest user base in East Africa, helping the bank provide inclusive financial services for over 18 million users in Kenya and other countries in East Africa.

Armed with this solution, banks can support the real economy and promote sustainable social development.

For more information, please visit the official website of Huawei Intelligent Finance.

.

Latest News

-

Gemini to cut quarter of workforce and exit UK, EU and Australia as crypto slump forces retrenchment

-

Bank ABC’s mobile-only ila bank migrates to core banking platform

-

Visa launches platform to accelerate small business growth in US

-

NatWest to expand Accelerator programme to 50,000 members in 2026

-

BBVA joins European stablecoin coalition

-

eToro partners with Amundi to launch equity portfolio with exposure to ‘megatrends’

Creating value together: Strategic partnerships in the age of GCCs

As Global Capability Centres reshape the financial services landscape, one question stands out: how do leading banks balance in-house innovation with strategic partnerships to drive real transformation?

Data trust in the AI era: Building customer confidence through responsible banking

In the second episode of FStech’s three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech examines the critical relationship between data trust, transparency, and responsible AI implementation in financial services.

Banking's GenAI evolution: Beyond the hype, building the future

In the first episode of a three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech explores how financial institutions can navigate the transformative potential of Generative AI while building lasting foundations for innovation.

Beyond compliance: Building unshakeable operational resilience in financial services

In today's rapidly evolving financial landscape, operational resilience has become a critical focus for institutions worldwide. As regulatory requirements grow more complex and cyber threats, particularly ransomware, become increasingly sophisticated, financial services providers must adapt and strengthen their defences. The intersection of compliance, technology, and security presents both challenges and opportunities.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories