Monzo has announced the launch of a new buildings insurance product.

The product will be combined with the neobank's existing contents insurance, which was rolled out in April.

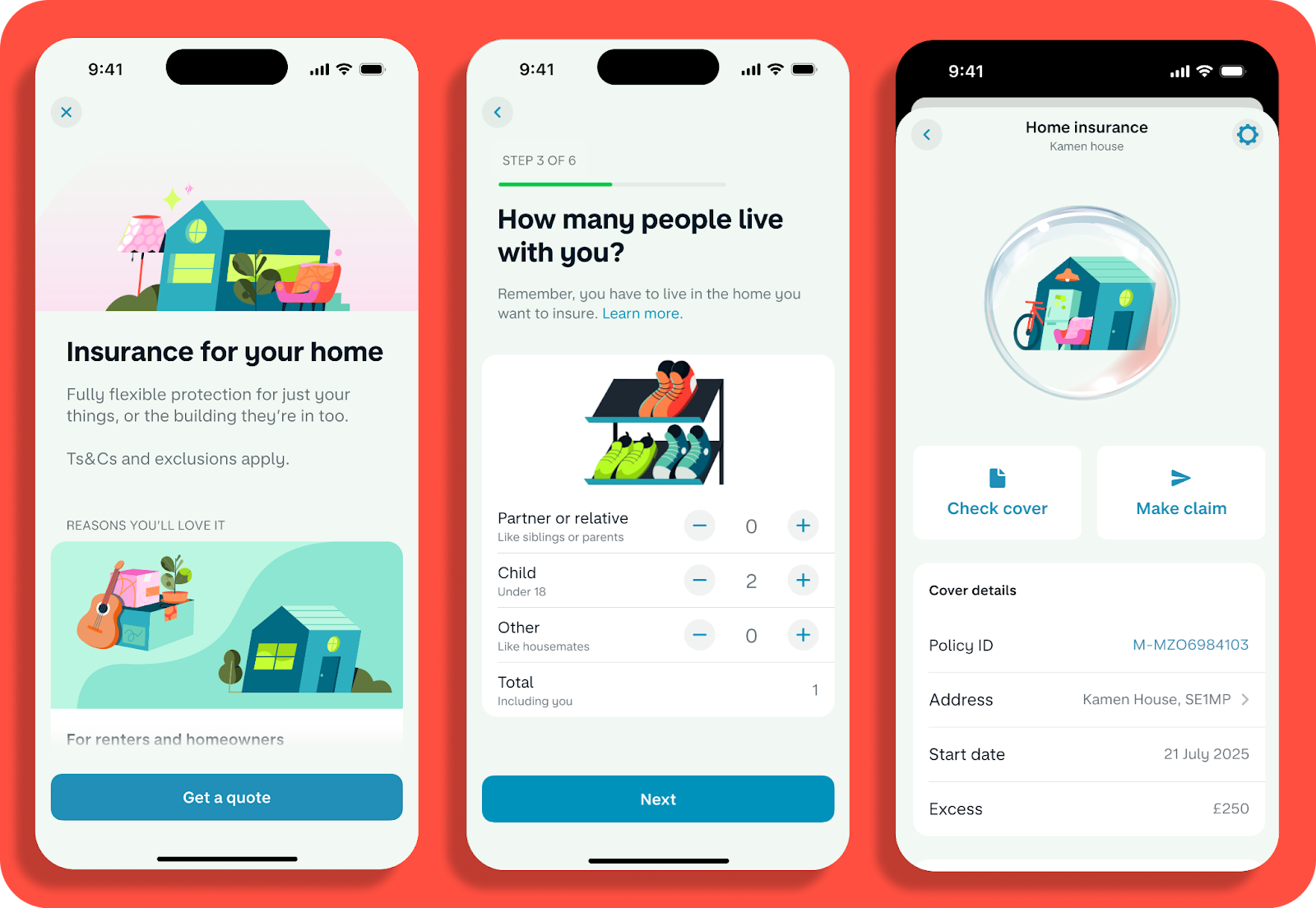

The combined home insurance means that both homeowners and renters will now be able to get the cover they need directly from the Monzo app.

The British neobank said the move would simplify the often “lengthy and complicated” process of taking out buildings insurance.

It added that homeowners are often locked in rigid yearly contracts, which don’t allow for changes in plans or circumstances without incurring additional charges.

The digital bank went on to say that Monzo Home Insurance will give customers more control to choose the cover that is right for them and change it at any time, with no additional fees.

"Your home is your biggest asset and protecting it shouldn’t be a headache. Our customers told us that they wanted something simpler - cover that actually fits their lives and changes when they do," said Phoebe Hugh, head of insurance at Monzo. "So we’ve introduced a fully flexible Home Insurance which makes it simple for homeowners to get the cover they need, change it at any time and manage their claims - all within the Monzo app.

"In line with our mission to make money work for everyone, we’re already deep into developing our next protection products, to bring the Monzo simplicity to every aspect of insurance."

Latest News

-

Mizuho to replace 5,000 administrative roles with AI

-

Allica achieves unicorn status through latest funding round

-

AI disruption risk varies between platform and service-based firms, says new report

-

ClearBank moves into the heart of London’s financial centre

-

Citi forms AI infrastructure banking team and invests in Sakana AI

-

HSBC chief Elhedery says overhaul nearly complete despite profit fall

Creating value together: Strategic partnerships in the age of GCCs

As Global Capability Centres reshape the financial services landscape, one question stands out: how do leading banks balance in-house innovation with strategic partnerships to drive real transformation?

Data trust in the AI era: Building customer confidence through responsible banking

In the second episode of FStech’s three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech examines the critical relationship between data trust, transparency, and responsible AI implementation in financial services.

Banking's GenAI evolution: Beyond the hype, building the future

In the first episode of a three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech explores how financial institutions can navigate the transformative potential of Generative AI while building lasting foundations for innovation.

Beyond compliance: Building unshakeable operational resilience in financial services

In today's rapidly evolving financial landscape, operational resilience has become a critical focus for institutions worldwide. As regulatory requirements grow more complex and cyber threats, particularly ransomware, become increasingly sophisticated, financial services providers must adapt and strengthen their defences. The intersection of compliance, technology, and security presents both challenges and opportunities.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories