Monzo has announced the launch of a new contents insurance product.

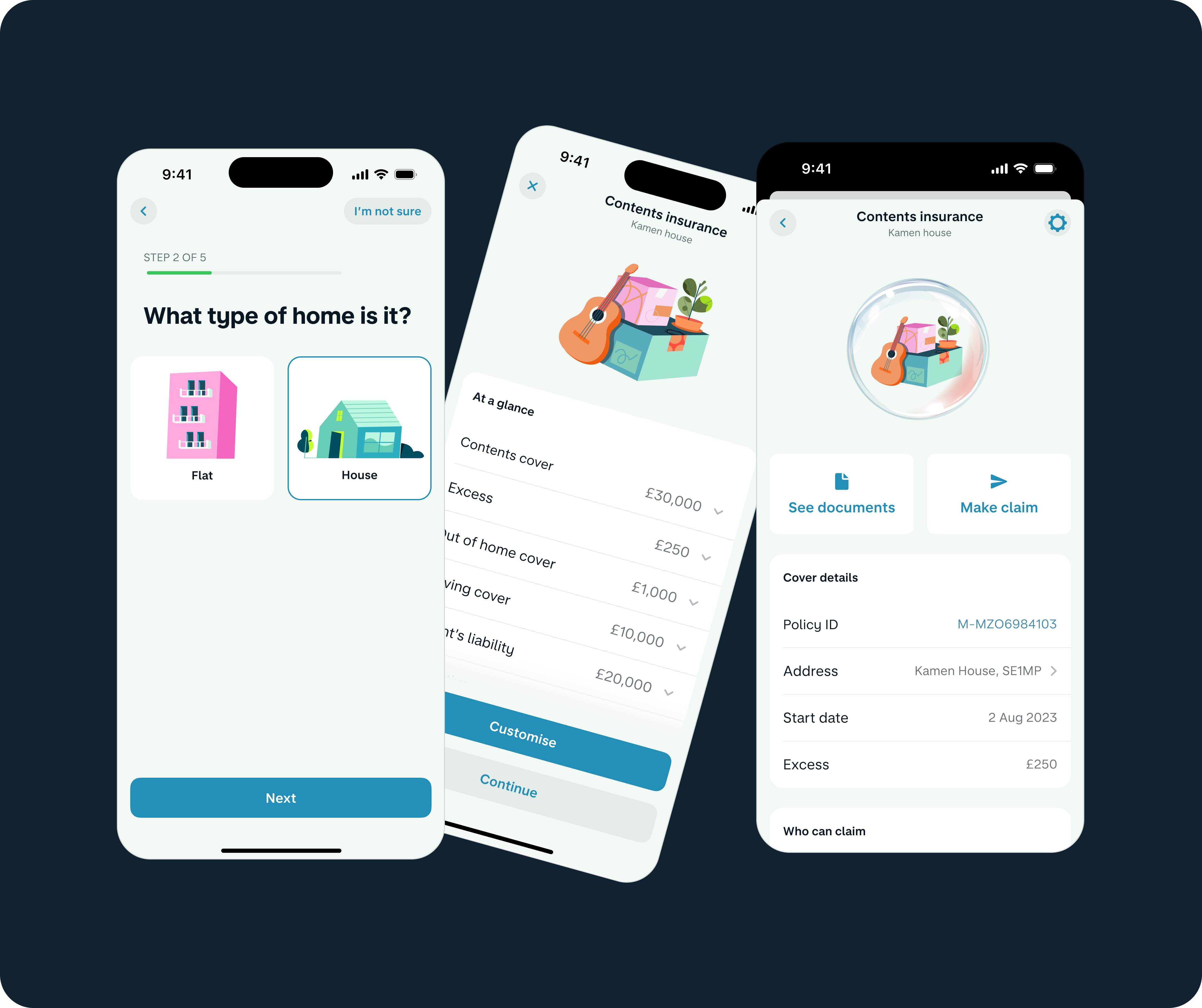

The company said it has build a “speedy application journey” with customisable cover that can be managed and tracked from the Monzo app.

Monzo customers can receive a quote after answering five questions.

The neobank said that it only asks what it needs to know, with the company filling out the rest based on information it already has about a customer.

Customers can choose how much they are covered for, including special, high-value items, and immediately see how customising their policy impacts the price.

The challenger bank has partnered with insurer Chubb for the contents insurance.

Chubb is the underwriter responsible for providing the cover and managing, approving, and paying out approved claims, while Monzo will collect monthly payments and help customers manage, change, or cancel their policy.

The new product is being rolled out over the next few weeks.

Monzo's foray into contents insurance comes off the back of a successful 2024, with the business reaching its first full year of profitability.

Across the 12-month period, pre-tax profits reached £15.4 million, while deposits soared by 88 per cent to £11.2 billion.

In August last year, Monzo was named the best bank in the UK for customer satisfaction, according to a major industry-wide survey.

The poll of more than 17,000 personal current account customers placed Starling Bank in second place and JP Morgan's Chase - which only launched in the UK three years ago - third.

The survey, which was organised by the Competition and Markets Authority (CMA) and is now in its seventh year, asked account holders to rate the quality of the services provided by their bank, including online banking, overdraft arrangements and their "in-branch" experience.

Latest News

-

Mizuho to replace 5,000 administrative roles with AI

-

Allica achieves unicorn status through latest funding round

-

AI disruption risk varies between platform and service-based firms, says new report

-

ClearBank moves into the heart of London’s financial centre

-

Citi forms AI infrastructure banking team and invests in Sakana AI

-

HSBC chief Elhedery says overhaul nearly complete despite profit fall

Creating value together: Strategic partnerships in the age of GCCs

As Global Capability Centres reshape the financial services landscape, one question stands out: how do leading banks balance in-house innovation with strategic partnerships to drive real transformation?

Data trust in the AI era: Building customer confidence through responsible banking

In the second episode of FStech’s three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech examines the critical relationship between data trust, transparency, and responsible AI implementation in financial services.

Banking's GenAI evolution: Beyond the hype, building the future

In the first episode of a three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech explores how financial institutions can navigate the transformative potential of Generative AI while building lasting foundations for innovation.

Beyond compliance: Building unshakeable operational resilience in financial services

In today's rapidly evolving financial landscape, operational resilience has become a critical focus for institutions worldwide. As regulatory requirements grow more complex and cyber threats, particularly ransomware, become increasingly sophisticated, financial services providers must adapt and strengthen their defences. The intersection of compliance, technology, and security presents both challenges and opportunities.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories